Le légendaire milliardaire arméno-américain disparait à l'age de 98 ans.

Le légendaire milliardaire arméno-américain disparait à l'age de 98 ans.

Fils d'immigrés arméniens , il bâtit sa fortune à force de courage. Pilote dans la RAF , il monte une compagnie d'avions privés. Mais c'est à Las Vegas qu'il batit sa fortune. Cinéma et voitures sont aussi sa passion : il achète et revend les studios MGM. Il monte au capital de Chrysler. Il tente une OPA sur Generla Motors. Il devient le propriétaire des hôtels de luxe MGM Resorts.

Avec sa fondation Lincy , il aide l'Arménie.

Il est mort à Los Angeles aujourd'hui , à l'âge de 98 ans. Il laisse deux filles Linda et Tracy

source : MGM Resorts (dont il était l'actionnaire principal)

—————————————————————————————————————

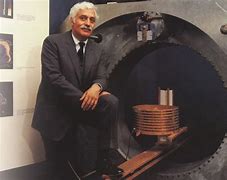

KIRK KERKORIAN

Kirkor (son prénom arménien) " Kirk " Kerkorian (6 Juin 1917 – 15 Juin , 2015) était un homme d'affaires américain . Il était le président / PDG de Tracinda Corporation , sa société financière privée basée à Beverly Hills, en Californie . Kerkorian est connu comme l'une des figures importantes dans l'élaboration de Las Vegas et , le «père du méga-complexe" . Il a construit trois fois le plus grand hôtel du monde à Las Vegas . : l'Hôtel International (ouvert en 1969 ), le MGM Grand Hôtel (1973 ) et le MGM Grand (1993 ) . Arménien d'Amérique , Kerkorian a donné plus d'1 milliard de dollars pour aider l'Arménie à travers sa Fondation Lincy . Celle-ci a été fondée en 1989 et a été particulièrement axée sur l'aide à la reconstruction du nord de l'Arménie après le tremblement de terre de 1988. La fondation a été dissoute en 2011 , après 22 ans d' activités .

Ses Jeunes Années :

Kirkor Kerkorian est né le 6 Juin 1917 à Fresno, en Californie, de parents immigrés arméniens. Il quitte l'école en huitième année, & devient assez bon boxeur amateur , sous la tutelle de son frère aîné, combattant sous le nom de" Rifle droit Kerkorian " pour remporter le championnat mi-amateur du Pacifique.

Sentant arriver la Seconde Guerre mondiale, et ne voulant pas rejoindre l'infanterie, il apprend à voler au "Bottom Bonne Riding Club" dans le désert de Mojave – (maintenant la base Edwards de l' Air Force ). En échange de leçons de pilotage de l'aviatrice pionnière Pancho Barnes, il accepte de s'occuper de son bétail. Après avoir obtenu sa licence de pilote professionnel en six mois, Kerkorian apprend que la Royal Air Force britannique construit un service de ferry de Havilland Mosquitos au-dessus de l'Atlantique nord vers l' Ecosse. Le réservoir de carburant de la Mosquito a suffisamment de carburant pour 1.400 miles (2300 km), tandis que le voyage direct est de 2,200 miles (3500 km). Plutôt que de prendre le plus sûr trajet Montréal-Labrador et le Groenland-Islande-Ecosse Kerkorian préfére la voie directe "L'Islande Wave" . La taxe est de 1000 $ par vol, mais les statistiques sont que seulement un sur quatre effectue le trajet. En mai 1944, Kerkorian et son "Wing Commander" JD Woolridge profitent de la vague et brisent l'ancien record de la traversée. Woolridge fait l'Ecosse en six heures, 46 minutes; Kerkorian, en sept heures, neuf minutes. En deux ans et demi avec "RAF Ferry Command", Kerkorian livre 33 avions, effectue des milliers d'heures de voyage sur quatre continents et vole avec son premier quadrimoteur. Après la guerre, ayant épargné la plupart de son salaire, Kerkorian dépense $ 5000 sur un Cessna. Il travaille comme pilote de l'aviation générale, et fait sa première visite à Las Vegas en 1944. Après avoir passé beaucoup de temps à Las Vegas dans les années 1940, Kerkorian quitte le jeu et en 1947 paye 60 000 $ pour Trans International Airlines, une petite compagnie de charter qui transporte les joueurs de Los Angeles à Las Vegas. Il investit ensuite sur certains bombardiers de surplus de guerre, en utilisant l'argent prêté par la famille Seagram. L'essence, et en particulier le carburant pour l'aviation, était en situation de pénurie à l'époque, donc il vend le carburant des cuves des avions, rembourse son prêt – et conserve les avions. Il dirige la compagnie jusqu'en 1968, et la revend pour 104 millions de dollars à la Transamerica Corporation.

Las Vegas

En 1962, Kerkorian achète 80 acres (32 ha) sur le Strip de Las Vegas à partir du Flamingo, pour $ 960,000. Cette acquisition entraîne la construction de Caesars Palace, qui loue le terrain de Kerkorian; la location et finalement la vente du terrain au Caesars en 1968 rapportent à Kerkorian 9 millions de $.

En 1967, il achète 82 acres (33 ha) de terres sur Paradise Road à Las Vegas pour 5 millions de dollars et construit l'Hôtel International, qui est à l'époque le plus grand hôtel dans le monde. Les deux premiers artistes à apparaître au Showroom International de l'hôtel sont Barbara Streisand et Elvis Presley. Presley amène certains des 4.200 clients et joueurs, tous les jours, pendant 30 jours d'affilée, brisant ,dans le processus, tous les records de fréquentation dans l'histoire du comté. International Leisure de Kerkorian achète aussi l'Hôtel Flamingo; finalement les deux hôtels sont vendus à Hilton Hotels Corporation et sont rebaptisés le Las Vegas Hilton et le Flamingo Hilton .

Après avoir acheté le studio de cinéma Metro-Goldwyn-Mayer en 1969, Kerkorian (avec comme architecte Martin Stern Jr.) ouvre le MGM Grand Hôtel original et Casino, plus grand que l'Empire State Building et le plus grand hôtel du monde à l'époque où il est terminé. Le 21 Novembre 1980, l'original MGM Grand brûle dans un incendie qui est l'une des pires catastrophes de l'histoire de Las Vegas. Le Service des incendies du comté de Clark signale 84 décès dans le feu; il y a 87 morts au total, dont trois qui sont décédés plus tard, à la suite de blessures subies dans le feu. Après seulement 8 mois, le MGM Grand rouvre. Près de trois mois après l'incendie du MGM,le Las Vegas Hilton prend feu, tuant huit personnes.

En 1986, Kerkorian vend les hôtels MGM Grand à Las Vegas et Reno pour $ 594 000 000 à Bally Manufacturing. La propriété de Las Vegas est renommée Bally. Séparée de Metro-Goldwyn-Mayer, MGM Resorts International possède et exploite plusieurs des propriétés, y compris le Bellagio, l'actuel complexe de villégiature MGM Grand, Le Mirage, le New York-New York, Circus Circus, Mandalay Bay, Luxor, Excalibur et le CityCenter nouvellement achevé à Las Vegas.

MGM vend sa propriété Treasure Island Hôtel et Casino au milliardaire et ancien propriétaire de New Frontier ,Phil Ruffin 750 millions de dollars.

MGM

En 1969, Kerkorian nomme James Thomas Aubrey, Jr. président de la MGM. Aubrey minimise le rôle d'une MGM en difficulté et vend des quantités massives de souvenirs historiques, y compris les pantoufles rubis de Dorothy du Magicien d'Oz, la majorité des backlots du studio à Culver City et les opérations à l'étranger comme le studio britannique MGM à Borehamwood. Kerkorian vend le système de distribution de la MGM en 1973, et prend progressivement ses distances du fonctionnement quotidien du studio. Il posséde également une participation minoritaire dans la Columbia Pictures, mais ses avoirs sont contrecarrés par le ministère de la Justice qui ouvre un procès antitrust car il détient des actions dans deux studios. En 1979, Kerkorian publie une déclaration affirmant que MGM est maintenant principalement une entreprise d'hôtellerie ; Toutefois, il réussit à élargir la cinémathèque globale et le système de production avec l'achat de United Artists de Transamerica en 1981, devenant MGM / UA Entertainment Company. En 1986, il vend MGM à Ted Turner. Après l'achat effectué, Turner revend la filiale United Artists à Kerkorian.

Turner garde la propriété de MGM du 25 Mars au 26 Août, 1986. Il accumule des dettes énormes et Turner ne peut tout simplement pas se permettre de garder le studio dans ces circonstances. Pour récupérer son investissement, Turner vendu les / des actifs de distribution de production et de commerce de MGM à United Artists, tout en conservant l'avant 1986 MGM et les pré-bibliothèques Warner Bros..de 1950 Le lot du studio a été vendue à Lorimar- Telepictures, qui est acquis par Warner Bros .; en 1990, le lot est vendu à Columbia Pictures Entertainment de Sony Corporation de Warner qu'ils avaient loué depuis les années 1970. Toujours en 1990, le studio MGM est acheté par le financier italien Giancarlo Parretti, qui fusionne l'ancien Cannon avec l'achat MGM pour créer les éphémères MGM-Pathé Communications. Parretti fait défaut sur les prêts qu'il avait obtenu pour acheter le studio, laissant le studio dans les mains de la banque française, le Crédit Lyonnais. Le Crédit Lyonnais investit des sommes importantes pour faire revivre le studio moribond et finalement le revend à nouveau à Kerkorian en 1996. Kerkorian élargit l'entreprise, avec l'achat d'Orion Pictures, The Samuel Goldwyn Company et Motion Picture Corporation of America à partir de Métromédia John Kluge en 1997, et achète une majorité à l'avant 1996 PolyGram Filmed Entertainment bibliothèque de son parent Philips, qui est en train de vendre PolyGram à Seagram.

En 2005, Kerkorian revend MGM fune ois de plus à un consortium mené par Sony. Il conserve une participation de 55% dans MGM Mirage.

Le 22 Novembre 2006, la société d'investissement Tracinda de Kerkorian offre d'acheter, 15 millions d'actions de MGM Mirage pour augmenter sa participation dans le géant des jeux à 61,7% de 56,3%, si elle est approuvée.

En mai 2009, après la fin d'une émission d'actions d' 1 milliard de dollars par MGM Mirage, Kerkorian et Tracinda perdent leur participation majoritaire dans la société de jeux, passant de 53,8 pour cent à 39 pour cent et même après s'être engagé à acheter 10 pour cent de la nouvelle émission d'actions , ils restent maintenant propriétaires minoritaires .

Le capitaine d'industrie automobile

Kerkorian aime l'industrie automobile américaine. Son implication commence en 1995, quand avec l'aide du pdg à la retraite de Chrysler Lee Iacocca, Kerkorian organise une tentative de prise de contrôle de la Chrysler Corporation. La direction de Chrysler traite l'OPA d' hostile, et après une longue bataille, Kerkorian annule ses plans et a vend sa participation de Chrysler en 1996. Dans le cadre de l'accord, il est interdit à Iacocca de discuter ou de publier sur Chrysler en public pendant cinq années. Deux ans plus tard, la direction de Chrysler accepte d'être acheté par le constructeur automobile allemand Daimler-Benz.

Kerkorian détenait autrefois 9,9 pour cent de General Motors (GM). Selon des rapports de presse, à partir de 30 Juin 2006, Kerkorian suggére que Renault acquiert une participation de 20 pour cent dans GM pour sauver GM de lui-même. Une lettre de Tracinda à Rick Wagoner est publiée, pour faire pression sur la hiérarchie de l'exécutif de GM, mais les pourparlers échouent Le 22 Novembre 2006 Kerkorian vend 14 millions d'actions de sa participation GM (il est spéculé que cette action est due au rejet de GM des offres de Renault et de Nissan pour des participations dans la société, que ces deux offres ont été fortement soutenus par Kerkorian); la vente entraîne une chute de 4,1%de l'action GM mais reste supérieur à 30 $ / action.La vente réduit la participation de Kerkorian à environ 7% de GM. Le 30 Novembre 2006 Tracinda déclare qu'il accepte de vendre encore 14 millions d'actions de GM .À la fin de Novembre 2006, il avait vendu la quasi-totalité de son solde des actions GM. GM perd alors plus de 90% de sa valeur, tombant aussi bas que 1 $ / action, en mai 2009, et dépose le bilan le 1er Juin 2009.

Le 5 Avril 2007, Kirk Kerkorian fait une offre de $ 4,58 milliards au Groupe Chrysler, la branche américaine de Daimler-Chrysler. Après que Daimler-Chrysler annonce qu'ils sont intéressés par la vente de la division Chrysler le 14 Février, les grands investisseurs tels que Cerberus Capital Management, The Blackstone Group et Magna International annoncent leur intérêt pour la société. L'offre de Kerkorian, ne surprend pas,étant donné sa longue implication dans l'industrie automobile américaine. Pendant le processus d'appel d'offres, il demande l'aide de son proche associé Jerome York, ancien directeur financier de Chrysler et IBM. Le 14 mai 2007 80% de la branche Chrysler de Daimler-Chrysler est vendue à Cerberus pour 7,4 milliards de $

Kerkorian commence à acheter des actions Ford Motor Company en Avril 2008, et dépense environ 1 milliard de dollars pour accumuler une participation de 6% dans le constructeur automobile. En Octobre 2008, l'investissement perd les deux tiers de sa valeur, et il commence à vendre. Tracinda explique: «À la lumière des conditions économiques et de marché actuelles, il voit une valeur unique dans le jeu, l'hôtellerie et des industries pétrolières et gazières , et , par conséquent, décide de réaffecter ses ressources et de se concentrer sur ces secteurs." Au 21 Octobre , Tracinda a vendu 7,3 millions d'actions Ford à un prix moyen de 2,43 $ et dit son intention de réduire davantage sa participation de 6,1 pour cent chez Ford, pour une perte totale potentielle de plus d'un demi-milliard de dollars. Kerkorian vend sa participation restante dans Ford le 29 Décembre 2008.

Un homme simple

Kerkorian est une personne très secrète.Il ne donne presque jamais d'interviews et apparait rarement en public.

Kerkorian est un tennisman averti.Il participe à des tournois, en équipe avec d'autres joueurs et joue régulièrement avec Alex Yemenidjian, un de ses directeurs à la MGM et à présent copropriétaire du complexe Tropicana Las Vegas . Il aime les vêtements de luxe spécialement ceux du couturier italien Brioni,mais conduit des voitures ordinaires comme une Pontiac Firebird,une Jeep Grand Cherokee et une Ford Taurus.On dit qu'il n'a pas de bureau mais utilise celui de ses collaborateurs.

Ses amours

Kerkorian se marrie 3 fois , d'abord avec Hilda Schmidt de 1942 à 1952.Puis à Jean Maree Harbour-Hardy,de 1954 à 1984. Ils se rencontrent & tombent amoureux au Thunderbird à Las Vegas. Ms. Harbour-Hardy est une choregraphe et danseuse anglaise .Ils ont deux filles Tracy and Linda, dont les prénoms servent à nommer la Tracinda Corporation, et la Lincy Foundation.

Le 3ème mariage avec Lisa Bonder, de 48 ans sa cadette,,dure 1 mois. Un procès oppose Kerkorian & Steve Bing, l'amant de Lisa et le père de sa fille,,paternité certifiée par un test ADN .

La Fondation Lincy

Le nom de sa Fondation Lincy,est composé des prénoms de ses deux filles "Lin" de Linda & "cy" de Tracy. Même si Lincy a donné plus d'$1 milliard Kerkorian n'a jamais permis que quoique ce soit soit nommé en son honneur. Lincy a donné ses 200 millions restant à l'université UCLA , la moitié pour la recherche médicale, l'autre moitié le "Dream Fund" pour des aides aux USA.

Il a été nommé "Héros de l'Arménie" , la plus haute distinction.

source : wikipedia USA

Your contribution will be used to improve translation quality and may be shown to users anonymously

Thank you for your submission.

Auto industry[edit] Kerkorian has had an on again/off again relationship with the American auto industry. His involvement began in 1995, when with the assistance of retired Chrysler chairman and CEO Lee Iacocca, Kerkorian staged a takeover attempt of the Chrysler Corporation. Chrysler’s management treated the takeover as hostile, and after a lengthy battle, Kerkorian canceled his plans and sold his Chrysler stake in 1996. As part of the settlement, Iacocca was placed under a gag order forbidding him from discussing Chrysler in public or print for five years. Two years later, Chrysler management agreed to be acquired by German automaker Daimler-Benz. Kerkorian once owned 9.9 percent of General Motors (GM). According to press accounts from June 30, 2006, Kerkorian suggested that Renault acquire a 20 percent stake in GM to rescue GM from itself. A letter from Tracinda to Rick Wagoner was released to the public,[24] to pressure GM’s executive hierarchy,[25] but talks failed.[26] On November 22, 2006 Kerkorian sold 14 million shares of his GM stake (it is speculated that this action was due to GM’s rejection of Renault and Nissan’s bids for stakes in the company as both of these bids were strongly supported by Kerkorian); the sale resulted in GM’s share price falling 4.1% from its November 20 price, although it remained above $30/share.[27] The sale lowered Kerkorian’s holding to around 7% of GM. On November 30, 2006 Tracinda said it had agreed to sell another 14 million shares of GM, cutting Kerkorian’s stake to half of what it had been earlier that year.[28] By the end of November 2006, he had sold substantially all of his remaining GM shares.[29] After Kerkorian sold, GM lost more than 90% of its value, falling as low as $1/share by May 2009,[30] and filed bankruptcy on June 1, 2009.[31] On April 5, 2007, Kirk Kerkorian made a $4.58 billion bid for the Chrysler Group, the U.S. arm of Daimler-Chrysler. After Daimler-Chrysler announced they were interested in selling the Chrysler division on February 14, large investors such as Cerberus Capital Management, The Blackstone Group and Magna International each announced intentions to bid on the company. Kerkorian’s bid, while not expected, was not surprising given his long involvement in the U.S. automobile industry. During the bidding process, he sought the aid of his close associate Jerome York who was a former CFO at both Chrysler and IBM. On May 14, 2007 80% of the Chrysler arm of Daimler-Chrysler was sold to Cerberus for $7.4 billion. Kerkorian began buying Ford Motor Company stock in April 2008, and spent about $1 billion to accumulate a 6% stake in the automaker. By October 2008, the investment had lost two thirds of its value, and he began selling. Tracinda explained, “In light of current economic and market conditions, it sees unique value in the gaming and hospitality and oil and gas industries and has, therefore, decided to reallocate its resources and to focus on those industries.”[32] On October 21, Tracinda sold the 7.3 million Ford shares at an average price of $2.43, and said it planned to cut further its existing 6.1 percent stake in Ford, for a potential total loss of more than half a billion dollars.[33] Kerkorian sold his remaining stake in Ford on December 29, 2008

Definitions of Auto industry[edit] Kerkorian has had an on again/off again relationship with the American auto industry. His involvement began in 1995, when with the assistance of retired Chrysler chairman and CEO Lee Iacocca, Kerkorian staged a takeover attempt of the Chrysler Corporation. Chrysler’s management treated the takeover as hostile, and after a lengthy battle, Kerkorian canceled his plans and sold his Chrysler stake in 1996. As part of the settlement, Iacocca was placed under a gag order forbidding him from discussing Chrysler in public or print for five years. Two years later, Chrysler management agreed to be acquired by German automaker Daimler-Benz. Kerkorian once owned 9.9 percent of General Motors (GM). According to press accounts from June 30, 2006, Kerkorian suggested that Renault acquire a 20 percent stake in GM to rescue GM from itself. A letter from Tracinda to Rick Wagoner was released to the public,[24] to pressure GM’s executive hierarchy,[25] but talks failed.[26] On November 22, 2006 Kerkorian sold 14 million shares of his GM stake (it is speculated that this action was due to GM’s rejection of Renault and Nissan’s bids for stakes in the company as both of these bids were strongly supported by Kerkorian); the sale resulted in GM’s share price falling 4.1% from its November 20 price, although it remained above $30/share.[27] The sale lowered Kerkorian’s holding to around 7% of GM. On November 30, 2006 Tracinda said it had agreed to sell another 14 million shares of GM, cutting Kerkorian’s stake to half of what it had been earlier that year.[28] By the end of November 2006, he had sold substantially all of his remaining GM shares.[29] After Kerkorian sold, GM lost more than 90% of its value, falling as low as $1/share by May 2009,[30] and filed bankruptcy on June 1, 2009.[31] On April 5, 2007, Kirk Kerkorian made a $4.58 billion bid for the Chrysler Group, the U.S. arm of Daimler-Chrysler. After Daimler-Chrysler announced they were interested in selling the Chrysler division on February 14, large investors such as Cerberus Capital Management, The Blackstone Group and Magna International each announced intentions to bid on the company. Kerkorian’s bid, while not expected, was not surprising given his long involvement in the U.S. automobile industry. During the bidding process, he sought the aid of his close associate Jerome York who was a former CFO at both Chrysler and IBM. On May 14, 2007 80% of the Chrysler arm of Daimler-Chrysler was sold to Cerberus for $7.4 billion. Kerkorian began buying Ford Motor Company stock in April 2008, and spent about $1 billion to accumulate a 6% stake in the automaker. By October 2008, the investment had lost two thirds of its value, and he began selling. Tracinda explained, “In light of current economic and market conditions, it sees unique value in the gaming and hospitality and oil and gas industries and has, therefore, decided to reallocate its resources and to focus on those industries.”[32] On October 21, Tracinda sold the 7.3 million Ford shares at an average price of $2.43, and said it planned to cut further its existing 6.1 percent stake in Ford, for a potential total loss of more than half a billion dollars.[33] Kerkorian sold his remaining stake in Ford on December 29, 2008

Synonyms of Auto industry[edit] Kerkorian has had an on again/off again relationship with the American auto industry. His involvement began in 1995, when with the assistance of retired Chrysler chairman and CEO Lee Iacocca, Kerkorian staged a takeover attempt of the Chrysler Corporation. Chrysler’s management treated the takeover as hostile, and after a lengthy battle, Kerkorian canceled his plans and sold his Chrysler stake in 1996. As part of the settlement, Iacocca was placed under a gag order forbidding him from discussing Chrysler in public or print for five years. Two years later, Chrysler management agreed to be acquired by German automaker Daimler-Benz. Kerkorian once owned 9.9 percent of General Motors (GM). According to press accounts from June 30, 2006, Kerkorian suggested that Renault acquire a 20 percent stake in GM to rescue GM from itself. A letter from Tracinda to Rick Wagoner was released to the public,[24] to pressure GM’s executive hierarchy,[25] but talks failed.[26] On November 22, 2006 Kerkorian sold 14 million shares of his GM stake (it is speculated that this action was due to GM’s rejection of Renault and Nissan’s bids for stakes in the company as both of these bids were strongly supported by Kerkorian); the sale resulted in GM’s share price falling 4.1% from its November 20 price, although it remained above $30/share.[27] The sale lowered Kerkorian’s holding to around 7% of GM. On November 30, 2006 Tracinda said it had agreed to sell another 14 million shares of GM, cutting Kerkorian’s stake to half of what it had been earlier that year.[28] By the end of November 2006, he had sold substantially all of his remaining GM shares.[29] After Kerkorian sold, GM lost more than 90% of its value, falling as low as $1/share by May 2009,[30] and filed bankruptcy on June 1, 2009.[31] On April 5, 2007, Kirk Kerkorian made a $4.58 billion bid for the Chrysler Group, the U.S. arm of Daimler-Chrysler. After Daimler-Chrysler announced they were interested in selling the Chrysler division on February 14, large investors such as Cerberus Capital Management, The Blackstone Group and Magna International each announced intentions to bid on the company. Kerkorian’s bid, while not expected, was not surprising given his long involvement in the U.S. automobile industry. During the bidding process, he sought the aid of his close associate Jerome York who was a former CFO at both Chrysler and IBM. On May 14, 2007 80% of the Chrysler arm of Daimler-Chrysler was sold to Cerberus for $7.4 billion. Kerkorian began buying Ford Motor Company stock in April 2008, and spent about $1 billion to accumulate a 6% stake in the automaker. By October 2008, the investment had lost two thirds of its value, and he began selling. Tracinda explained, “In light of current economic and market conditions, it sees unique value in the gaming and hospitality and oil and gas industries and has, therefore, decided to reallocate its resources and to focus on those industries.”[32] On October 21, Tracinda sold the 7.3 million Ford shares at an average price of $2.43, and said it planned to cut further its existing 6.1 percent stake in Ford, for a potential total loss of more than half a billion dollars.[33] Kerkorian sold his remaining stake in Ford on December 29, 2008

Examples of Auto industry[edit] Kerkorian has had an on again/off again relationship with the American auto industry. His involvement began in 1995, when with the assistance of retired Chrysler chairman and CEO Lee Iacocca, Kerkorian staged a takeover attempt of the Chrysler Corporation. Chrysler’s management treated the takeover as hostile, and after a lengthy battle, Kerkorian canceled his plans and sold his Chrysler stake in 1996. As part of the settlement, Iacocca was placed under a gag order forbidding him from discussing Chrysler in public or print for five years. Two years later, Chrysler management agreed to be acquired by German automaker Daimler-Benz. Kerkorian once owned 9.9 percent of General Motors (GM). According to press accounts from June 30, 2006, Kerkorian suggested that Renault acquire a 20 percent stake in GM to rescue GM from itself. A letter from Tracinda to Rick Wagoner was released to the public,[24] to pressure GM’s executive hierarchy,[25] but talks failed.[26] On November 22, 2006 Kerkorian sold 14 million shares of his GM stake (it is speculated that this action was due to GM’s rejection of Renault and Nissan’s bids for stakes in the company as both of these bids were strongly supported by Kerkorian); the sale resulted in GM’s share price falling 4.1% from its November 20 price, although it remained above $30/share.[27] The sale lowered Kerkorian’s holding to around 7% of GM. On November 30, 2006 Tracinda said it had agreed to sell another 14 million shares of GM, cutting Kerkorian’s stake to half of what it had been earlier that year.[28] By the end of November 2006, he had sold substantially all of his remaining GM shares.[29] After Kerkorian sold, GM lost more than 90% of its value, falling as low as $1/share by May 2009,[30] and filed bankruptcy on June 1, 2009.[31] On April 5, 2007, Kirk Kerkorian made a $4.58 billion bid for the Chrysler Group, the U.S. arm of Daimler-Chrysler. After Daimler-Chrysler announced they were interested in selling the Chrysler division on February 14, large investors such as Cerberus Capital Management, The Blackstone Group and Magna International each announced intentions to bid on the company. Kerkorian’s bid, while not expected, was not surprising given his long involvement in the U.S. automobile industry. During the bidding process, he sought the aid of his close associate Jerome York who was a former CFO at both Chrysler and IBM. On May 14, 2007 80% of the Chrysler arm of Daimler-Chrysler was sold to Cerberus for $7.4 billion. Kerkorian began buying Ford Motor Company stock in April 2008, and spent about $1 billion to accumulate a 6% stake in the automaker. By October 2008, the investment had lost two thirds of its value, and he began selling. Tracinda explained, “In light of current economic and market conditions, it sees unique value in the gaming and hospitality and oil and gas industries and has, therefore, decided to reallocate its resources and to focus on those industries.”[32] On October 21, Tracinda sold the 7.3 million Ford shares at an average price of $2.43, and said it planned to cut further its existing 6.1 percent stake in Ford, for a potential total loss of more than half a billion dollars.[33] Kerkorian sold his remaining stake in Ford on December 29, 2008

Translations of Auto industry[edit] Kerkorian has had an on again/off again relationship with the American auto industry. His involvement began in 1995, when with the assistance of retired Chrysler chairman and CEO Lee Iacocca, Kerkorian staged a takeover attempt of the Chrysler Corporation. Chrysler’s management treated the takeover as hostile, and after a lengthy battle, Kerkorian canceled his plans and sold his Chrysler stake in 1996. As part of the settlement, Iacocca was placed under a gag order forbidding him from discussing Chrysler in public or print for five years. Two years later, Chrysler management agreed to be acquired by German automaker Daimler-Benz. Kerkorian once owned 9.9 percent of General Motors (GM). According to press accounts from June 30, 2006, Kerkorian suggested that Renault acquire a 20 percent stake in GM to rescue GM from itself. A letter from Tracinda to Rick Wagoner was released to the public,[24] to pressure GM’s executive hierarchy,[25] but talks failed.[26] On November 22, 2006 Kerkorian sold 14 million shares of his GM stake (it is speculated that this action was due to GM’s rejection of Renault and Nissan’s bids for stakes in the company as both of these bids were strongly supported by Kerkorian); the sale resulted in GM’s share price falling 4.1% from its November 20 price, although it remained above $30/share.[27] The sale lowered Kerkorian’s holding to around 7% of GM. On November 30, 2006 Tracinda said it had agreed to sell another 14 million shares of GM, cutting Kerkorian’s stake to half of what it had been earlier that year.[28] By the end of November 2006, he had sold substantially all of his remaining GM shares.[29] After Kerkorian sold, GM lost more than 90% of its value, falling as low as $1/share by May 2009,[30] and filed bankruptcy on June 1, 2009.[31] On April 5, 2007, Kirk Kerkorian made a $4.58 billion bid for the Chrysler Group, the U.S. arm of Daimler-Chrysler. After Daimler-Chrysler announced they were interested in selling the Chrysler division on February 14, large investors such as Cerberus Capital Management, The Blackstone Group and Magna International each announced intentions to bid on the company. Kerkorian’s bid, while not expected, was not surprising given his long involvement in the U.S. automobile industry. During the bidding process, he sought the aid of his close associate Jerome York who was a former CFO at both Chrysler and IBM. On May 14, 2007 80% of the Chrysler arm of Daimler-Chrysler was sold to Cerberus for $7.4 billion. Kerkorian began buying Ford Motor Company stock in April 2008, and spent about $1 billion to accumulate a 6% stake in the automaker. By October 2008, the investment had lost two thirds of its value, and he began selling. Tracinda explained, “In light of current economic and market conditions, it sees unique value in the gaming and hospitality and oil and gas industries and has, therefore, decided to reallocate its resources and to focus on those industries.”[32] On October 21, Tracinda sold the 7.3 million Ford shares at an average price of $2.43, and said it planned to cut further its existing 6.1 percent stake in Ford, for a potential total loss of more than half a billion dollars.[33] Kerkorian sold his remaining stake in Ford on December 29, 2008

Drag and drop file or link here to translate the document or web page.

Drag and drop link here to translate the web page.

We do not support the type of file you drop. Please try other file types.

We do not support the type of link you drop. Please try link of other types.

Votre contribution sera utilisée pour améliorer la qualité de la traduction et peut être suggérée aux utilisateurs de façon anonyme.

Merci de votre envoi.

In 1969, Kerkorian appointed James Thomas Aubrey, Jr. as president of MGM. Aubrey downsized the struggling MGM and sold off massive amounts of historical memorabilia, including Dorothy's ruby slippers from The Wizard of Oz, the majority of the studio's backlots in Culver City and overseas operations such as the British MGM studio at Borehamwood. Kerkorian sold MGM's distribution system in 1973, and gradually distanced himself from the daily operation of the studio. He also owned minority interest in Columbia Pictures but his holdings were thwarted by the Justice Department who filed an antitrust suit due to him owning stock in two studios.[14] In 1979, Kerkorian issued a statement claiming that MGM was now primarily a hotel company; however, he also managed to expand the overall film library and production system with the purchase of United Artists from Transamerica in 1981, becoming MGM/UA Entertainment Company. In 1986, he sold MGM to Ted Turner.[15] After the purchase was made, Turner sold the United Artists subsidiary back to Kerkorian.[16][17] Turner kept ownership of MGM from March 25 to August 26, 1986. He racked up huge debts and Turner simply could not afford to keep the studio under those circumstances. To recoup his investment, Turner sold the production/distribution assets and trademarks of MGM to United Artists, while retaining the pre-1986 MGM and pre-1950 Warner Bros. libraries.[15][18] The studio lot was sold to Lorimar-Telepictures, which was later acquired by Warner Bros.; in 1990, the lot was sold to Sony Corporation’s Columbia Pictures Entertainment in exchange for the half of Warner’s lot that they had rented since the 1970s. Also in 1990, the MGM studio was purchased by Italian financier Giancarlo Parretti, who then merged the former Cannon with the MGM purchase to create the short-lived MGM-Pathé Communications. Parretti defaulted on the loans he’d used to buy the studio, leaving the studio in the hands of the French bank, Credit Lyonnais. Credit Lyonnais invested significant sums to revive the moribund studio and eventually sold it back to Kerkorian in 1996. Kerkorian soon expanded the company, purchasing Orion Pictures, The Samuel Goldwyn Company and Motion Picture Corporation of America from John Kluge’s Metromedia in 1997, and bought a majority to the pre-1996 PolyGram Filmed Entertainment library from its parent Philips, which was in process to sell PolyGram to Seagram. In 2005, Kerkorian sold MGM once more to a consortium led by Sony. He retained a 55% stake in MGM Mirage. On November 22, 2006, Kerkorian’s Tracinda investment corporation offered to buy 15 million shares of MGM Mirage to increase his stake in the gambling giant to 61.7% from 56.3%, if approved.[19] In May 2009, following the completion of a $1 billion stock offering by MGM Mirage, Kerkorian and Tracinda lost their majority ownership of the gaming company, dropping from 53.8 percent to 39 percent and even after pledging to purchase 10 percent of the new stock offering they now remain minority owners

Définitions de In 1969, Kerkorian appointed James Thomas Aubrey, Jr. as president of MGM. Aubrey downsized the struggling MGM and sold off massive amounts of historical memorabilia, including Dorothy's ruby slippers from The Wizard of Oz, the majority of the studio's backlots in Culver City and overseas operations such as the British MGM studio at Borehamwood. Kerkorian sold MGM's distribution system in 1973, and gradually distanced himself from the daily operation of the studio. He also owned minority interest in Columbia Pictures but his holdings were thwarted by the Justice Department who filed an antitrust suit due to him owning stock in two studios.[14] In 1979, Kerkorian issued a statement claiming that MGM was now primarily a hotel company; however, he also managed to expand the overall film library and production system with the purchase of United Artists from Transamerica in 1981, becoming MGM/UA Entertainment Company. In 1986, he sold MGM to Ted Turner.[15] After the purchase was made, Turner sold the United Artists subsidiary back to Kerkorian.[16][17] Turner kept ownership of MGM from March 25 to August 26, 1986. He racked up huge debts and Turner simply could not afford to keep the studio under those circumstances. To recoup his investment, Turner sold the production/distribution assets and trademarks of MGM to United Artists, while retaining the pre-1986 MGM and pre-1950 Warner Bros. libraries.[15][18] The studio lot was sold to Lorimar-Telepictures, which was later acquired by Warner Bros.; in 1990, the lot was sold to Sony Corporation’s Columbia Pictures Entertainment in exchange for the half of Warner’s lot that they had rented since the 1970s. Also in 1990, the MGM studio was purchased by Italian financier Giancarlo Parretti, who then merged the former Cannon with the MGM purchase to create the short-lived MGM-Pathé Communications. Parretti defaulted on the loans he’d used to buy the studio, leaving the studio in the hands of the French bank, Credit Lyonnais. Credit Lyonnais invested significant sums to revive the moribund studio and eventually sold it back to Kerkorian in 1996. Kerkorian soon expanded the company, purchasing Orion Pictures, The Samuel Goldwyn Company and Motion Picture Corporation of America from John Kluge’s Metromedia in 1997, and bought a majority to the pre-1996 PolyGram Filmed Entertainment library from its parent Philips, which was in process to sell PolyGram to Seagram. In 2005, Kerkorian sold MGM once more to a consortium led by Sony. He retained a 55% stake in MGM Mirage. On November 22, 2006, Kerkorian’s Tracinda investment corporation offered to buy 15 million shares of MGM Mirage to increase his stake in the gambling giant to 61.7% from 56.3%, if approved.[19] In May 2009, following the completion of a $1 billion stock offering by MGM Mirage, Kerkorian and Tracinda lost their majority ownership of the gaming company, dropping from 53.8 percent to 39 percent and even after pledging to purchase 10 percent of the new stock offering they now remain minority owners

Synonymes de In 1969, Kerkorian appointed James Thomas Aubrey, Jr. as president of MGM. Aubrey downsized the struggling MGM and sold off massive amounts of historical memorabilia, including Dorothy's ruby slippers from The Wizard of Oz, the majority of the studio's backlots in Culver City and overseas operations such as the British MGM studio at Borehamwood. Kerkorian sold MGM's distribution system in 1973, and gradually distanced himself from the daily operation of the studio. He also owned minority interest in Columbia Pictures but his holdings were thwarted by the Justice Department who filed an antitrust suit due to him owning stock in two studios.[14] In 1979, Kerkorian issued a statement claiming that MGM was now primarily a hotel company; however, he also managed to expand the overall film library and production system with the purchase of United Artists from Transamerica in 1981, becoming MGM/UA Entertainment Company. In 1986, he sold MGM to Ted Turner.[15] After the purchase was made, Turner sold the United Artists subsidiary back to Kerkorian.[16][17] Turner kept ownership of MGM from March 25 to August 26, 1986. He racked up huge debts and Turner simply could not afford to keep the studio under those circumstances. To recoup his investment, Turner sold the production/distribution assets and trademarks of MGM to United Artists, while retaining the pre-1986 MGM and pre-1950 Warner Bros. libraries.[15][18] The studio lot was sold to Lorimar-Telepictures, which was later acquired by Warner Bros.; in 1990, the lot was sold to Sony Corporation’s Columbia Pictures Entertainment in exchange for the half of Warner’s lot that they had rented since the 1970s. Also in 1990, the MGM studio was purchased by Italian financier Giancarlo Parretti, who then merged the former Cannon with the MGM purchase to create the short-lived MGM-Pathé Communications. Parretti defaulted on the loans he’d used to buy the studio, leaving the studio in the hands of the French bank, Credit Lyonnais. Credit Lyonnais invested significant sums to revive the moribund studio and eventually sold it back to Kerkorian in 1996. Kerkorian soon expanded the company, purchasing Orion Pictures, The Samuel Goldwyn Company and Motion Picture Corporation of America from John Kluge’s Metromedia in 1997, and bought a majority to the pre-1996 PolyGram Filmed Entertainment library from its parent Philips, which was in process to sell PolyGram to Seagram. In 2005, Kerkorian sold MGM once more to a consortium led by Sony. He retained a 55% stake in MGM Mirage. On November 22, 2006, Kerkorian’s Tracinda investment corporation offered to buy 15 million shares of MGM Mirage to increase his stake in the gambling giant to 61.7% from 56.3%, if approved.[19] In May 2009, following the completion of a $1 billion stock offering by MGM Mirage, Kerkorian and Tracinda lost their majority ownership of the gaming company, dropping from 53.8 percent to 39 percent and even after pledging to purchase 10 percent of the new stock offering they now remain minority owners

Exemples de In 1969, Kerkorian appointed James Thomas Aubrey, Jr. as president of MGM. Aubrey downsized the struggling MGM and sold off massive amounts of historical memorabilia, including Dorothy's ruby slippers from The Wizard of Oz, the majority of the studio's backlots in Culver City and overseas operations such as the British MGM studio at Borehamwood. Kerkorian sold MGM's distribution system in 1973, and gradually distanced himself from the daily operation of the studio. He also owned minority interest in Columbia Pictures but his holdings were thwarted by the Justice Department who filed an antitrust suit due to him owning stock in two studios.[14] In 1979, Kerkorian issued a statement claiming that MGM was now primarily a hotel company; however, he also managed to expand the overall film library and production system with the purchase of United Artists from Transamerica in 1981, becoming MGM/UA Entertainment Company. In 1986, he sold MGM to Ted Turner.[15] After the purchase was made, Turner sold the United Artists subsidiary back to Kerkorian.[16][17] Turner kept ownership of MGM from March 25 to August 26, 1986. He racked up huge debts and Turner simply could not afford to keep the studio under those circumstances. To recoup his investment, Turner sold the production/distribution assets and trademarks of MGM to United Artists, while retaining the pre-1986 MGM and pre-1950 Warner Bros. libraries.[15][18] The studio lot was sold to Lorimar-Telepictures, which was later acquired by Warner Bros.; in 1990, the lot was sold to Sony Corporation’s Columbia Pictures Entertainment in exchange for the half of Warner’s lot that they had rented since the 1970s. Also in 1990, the MGM studio was purchased by Italian financier Giancarlo Parretti, who then merged the former Cannon with the MGM purchase to create the short-lived MGM-Pathé Communications. Parretti defaulted on the loans he’d used to buy the studio, leaving the studio in the hands of the French bank, Credit Lyonnais. Credit Lyonnais invested significant sums to revive the moribund studio and eventually sold it back to Kerkorian in 1996. Kerkorian soon expanded the company, purchasing Orion Pictures, The Samuel Goldwyn Company and Motion Picture Corporation of America from John Kluge’s Metromedia in 1997, and bought a majority to the pre-1996 PolyGram Filmed Entertainment library from its parent Philips, which was in process to sell PolyGram to Seagram. In 2005, Kerkorian sold MGM once more to a consortium led by Sony. He retained a 55% stake in MGM Mirage. On November 22, 2006, Kerkorian’s Tracinda investment corporation offered to buy 15 million shares of MGM Mirage to increase his stake in the gambling giant to 61.7% from 56.3%, if approved.[19] In May 2009, following the completion of a $1 billion stock offering by MGM Mirage, Kerkorian and Tracinda lost their majority ownership of the gaming company, dropping from 53.8 percent to 39 percent and even after pledging to purchase 10 percent of the new stock offering they now remain minority owners

Traductions de In 1969, Kerkorian appointed James Thomas Aubrey, Jr. as president of MGM. Aubrey downsized the struggling MGM and sold off massive amounts of historical memorabilia, including Dorothy's ruby slippers from The Wizard of Oz, the majority of the studio's backlots in Culver City and overseas operations such as the British MGM studio at Borehamwood. Kerkorian sold MGM's distribution system in 1973, and gradually distanced himself from the daily operation of the studio. He also owned minority interest in Columbia Pictures but his holdings were thwarted by the Justice Department who filed an antitrust suit due to him owning stock in two studios.[14] In 1979, Kerkorian issued a statement claiming that MGM was now primarily a hotel company; however, he also managed to expand the overall film library and production system with the purchase of United Artists from Transamerica in 1981, becoming MGM/UA Entertainment Company. In 1986, he sold MGM to Ted Turner.[15] After the purchase was made, Turner sold the United Artists subsidiary back to Kerkorian.[16][17] Turner kept ownership of MGM from March 25 to August 26, 1986. He racked up huge debts and Turner simply could not afford to keep the studio under those circumstances. To recoup his investment, Turner sold the production/distribution assets and trademarks of MGM to United Artists, while retaining the pre-1986 MGM and pre-1950 Warner Bros. libraries.[15][18] The studio lot was sold to Lorimar-Telepictures, which was later acquired by Warner Bros.; in 1990, the lot was sold to Sony Corporation’s Columbia Pictures Entertainment in exchange for the half of Warner’s lot that they had rented since the 1970s. Also in 1990, the MGM studio was purchased by Italian financier Giancarlo Parretti, who then merged the former Cannon with the MGM purchase to create the short-lived MGM-Pathé Communications. Parretti defaulted on the loans he’d used to buy the studio, leaving the studio in the hands of the French bank, Credit Lyonnais. Credit Lyonnais invested significant sums to revive the moribund studio and eventually sold it back to Kerkorian in 1996. Kerkorian soon expanded the company, purchasing Orion Pictures, The Samuel Goldwyn Company and Motion Picture Corporation of America from John Kluge’s Metromedia in 1997, and bought a majority to the pre-1996 PolyGram Filmed Entertainment library from its parent Philips, which was in process to sell PolyGram to Seagram. In 2005, Kerkorian sold MGM once more to a consortium led by Sony. He retained a 55% stake in MGM Mirage. On November 22, 2006, Kerkorian’s Tracinda investment corporation offered to buy 15 million shares of MGM Mirage to increase his stake in the gambling giant to 61.7% from 56.3%, if approved.[19] In May 2009, following the completion of a $1 billion stock offering by MGM Mirage, Kerkorian and Tracinda lost their majority ownership of the gaming company, dropping from 53.8 percent to 39 percent and even after pledging to purchase 10 percent of the new stock offering they now remain minority owners

Faites glisser et déposez le fichier ou le lien ici pour traduire le document ou la page Web.

Faites glisser et déposez le lien ici pour traduire la page Web.

Le type de fichier déposé n'est pas pris en charge. Veuillez réessayer avec d'autres types de fichiers.

Le type de lien déposé n'est pas pris en charge. Veuillez réessayer avec d'autres types de liens.

Votre contribution sera utilisée pour améliorer la qualité de la traduction et peut être suggérée aux utilisateurs de façon anonyme.

Merci de votre envoi.

Las Vegas[edit] In 1962, Kerkorian bought 80 acres (32 ha) in Las Vegas, across the Las Vegas Strip from the Flamingo, for $960,000. This purchase led to the building of Caesars Palace, which rented the land from Kerkorian; the rent and eventual sale of the land to Caesars in 1968 made Kerkorian $9 million. In 1967, he bought 82 acres (33 ha) of land on Paradise Road in Las Vegas for $5 million and, with architect Martin Stern, Jr.,[11] built the International Hotel, which at the time was the largest hotel in the world; The first two performers to appear at the hotel’s enormous Showroom Internationale were Barbra Streisand and Elvis Presley. Presley brought in some 4,200 customers (and potential gamblers), every day, for 30 days straight, breaking in the process all attendance records in the county’s history. Kerkorian’s International Leisure also bought the Flamingo Hotel; eventually both hotels were sold to the Hilton Hotels Corporation and were renamed the Las Vegas Hilton and the Flamingo Hilton, respectively. After he purchased the Metro-Goldwyn-Mayer movie studio in 1969, Kerkorian (with architect Martin Stern Jr.) opened the original MGM Grand Hotel and Casino, larger than the Empire State Building[12] and the largest hotel in the world at the time it was finished. On November 21, 1980, the original MGM Grand burned in a fire that was one of the worst disasters in Las Vegas history. The Clark County Fire Department reported 84 deaths in the fire; there were 87 deaths total, including three which occurred later as a result of injuries sustained in the fire. After only 8 months the MGM Grand reopened. Almost three months after the MGM fire, the Las Vegas Hilton caught fire, killing eight people. In 1986, Kerkorian sold the MGM Grand hotels in Las Vegas and Reno for $594 million to Bally Manufacturing. The Las Vegas property was subsequently renamed Bally’s. Spun off from Metro-Goldwyn-Mayer, MGM Resorts International owns and operates several properties, including the Bellagio, the current MGM Grand resort complex, The Mirage, the New York-New York, Circus Circus, Mandalay Bay, The Luxor, Excalibur and the newly completed CityCenter in Las Vegas. MGM sold its Treasure Island Hotel and Casino property to billionaire and former New Frontier owner Phil Ruffin for $750 million.[13]

Définitions de Las Vegas[edit] In 1962, Kerkorian bought 80 acres (32 ha) in Las Vegas, across the Las Vegas Strip from the Flamingo, for $960,000. This purchase led to the building of Caesars Palace, which rented the land from Kerkorian; the rent and eventual sale of the land to Caesars in 1968 made Kerkorian $9 million. In 1967, he bought 82 acres (33 ha) of land on Paradise Road in Las Vegas for $5 million and, with architect Martin Stern, Jr.,[11] built the International Hotel, which at the time was the largest hotel in the world; The first two performers to appear at the hotel’s enormous Showroom Internationale were Barbra Streisand and Elvis Presley. Presley brought in some 4,200 customers (and potential gamblers), every day, for 30 days straight, breaking in the process all attendance records in the county’s history. Kerkorian’s International Leisure also bought the Flamingo Hotel; eventually both hotels were sold to the Hilton Hotels Corporation and were renamed the Las Vegas Hilton and the Flamingo Hilton, respectively. After he purchased the Metro-Goldwyn-Mayer movie studio in 1969, Kerkorian (with architect Martin Stern Jr.) opened the original MGM Grand Hotel and Casino, larger than the Empire State Building[12] and the largest hotel in the world at the time it was finished. On November 21, 1980, the original MGM Grand burned in a fire that was one of the worst disasters in Las Vegas history. The Clark County Fire Department reported 84 deaths in the fire; there were 87 deaths total, including three which occurred later as a result of injuries sustained in the fire. After only 8 months the MGM Grand reopened. Almost three months after the MGM fire, the Las Vegas Hilton caught fire, killing eight people. In 1986, Kerkorian sold the MGM Grand hotels in Las Vegas and Reno for $594 million to Bally Manufacturing. The Las Vegas property was subsequently renamed Bally’s. Spun off from Metro-Goldwyn-Mayer, MGM Resorts International owns and operates several properties, including the Bellagio, the current MGM Grand resort complex, The Mirage, the New York-New York, Circus Circus, Mandalay Bay, The Luxor, Excalibur and the newly completed CityCenter in Las Vegas. MGM sold its Treasure Island Hotel and Casino property to billionaire and former New Frontier owner Phil Ruffin for $750 million.[13]

Synonymes de Las Vegas[edit] In 1962, Kerkorian bought 80 acres (32 ha) in Las Vegas, across the Las Vegas Strip from the Flamingo, for $960,000. This purchase led to the building of Caesars Palace, which rented the land from Kerkorian; the rent and eventual sale of the land to Caesars in 1968 made Kerkorian $9 million. In 1967, he bought 82 acres (33 ha) of land on Paradise Road in Las Vegas for $5 million and, with architect Martin Stern, Jr.,[11] built the International Hotel, which at the time was the largest hotel in the world; The first two performers to appear at the hotel’s enormous Showroom Internationale were Barbra Streisand and Elvis Presley. Presley brought in some 4,200 customers (and potential gamblers), every day, for 30 days straight, breaking in the process all attendance records in the county’s history. Kerkorian’s International Leisure also bought the Flamingo Hotel; eventually both hotels were sold to the Hilton Hotels Corporation and were renamed the Las Vegas Hilton and the Flamingo Hilton, respectively. After he purchased the Metro-Goldwyn-Mayer movie studio in 1969, Kerkorian (with architect Martin Stern Jr.) opened the original MGM Grand Hotel and Casino, larger than the Empire State Building[12] and the largest hotel in the world at the time it was finished. On November 21, 1980, the original MGM Grand burned in a fire that was one of the worst disasters in Las Vegas history. The Clark County Fire Department reported 84 deaths in the fire; there were 87 deaths total, including three which occurred later as a result of injuries sustained in the fire. After only 8 months the MGM Grand reopened. Almost three months after the MGM fire, the Las Vegas Hilton caught fire, killing eight people. In 1986, Kerkorian sold the MGM Grand hotels in Las Vegas and Reno for $594 million to Bally Manufacturing. The Las Vegas property was subsequently renamed Bally’s. Spun off from Metro-Goldwyn-Mayer, MGM Resorts International owns and operates several properties, including the Bellagio, the current MGM Grand resort complex, The Mirage, the New York-New York, Circus Circus, Mandalay Bay, The Luxor, Excalibur and the newly completed CityCenter in Las Vegas. MGM sold its Treasure Island Hotel and Casino property to billionaire and former New Frontier owner Phil Ruffin for $750 million.[13]

Exemples de Las Vegas[edit] In 1962, Kerkorian bought 80 acres (32 ha) in Las Vegas, across the Las Vegas Strip from the Flamingo, for $960,000. This purchase led to the building of Caesars Palace, which rented the land from Kerkorian; the rent and eventual sale of the land to Caesars in 1968 made Kerkorian $9 million. In 1967, he bought 82 acres (33 ha) of land on Paradise Road in Las Vegas for $5 million and, with architect Martin Stern, Jr.,[11] built the International Hotel, which at the time was the largest hotel in the world; The first two performers to appear at the hotel’s enormous Showroom Internationale were Barbra Streisand and Elvis Presley. Presley brought in some 4,200 customers (and potential gamblers), every day, for 30 days straight, breaking in the process all attendance records in the county’s history. Kerkorian’s International Leisure also bought the Flamingo Hotel; eventually both hotels were sold to the Hilton Hotels Corporation and were renamed the Las Vegas Hilton and the Flamingo Hilton, respectively. After he purchased the Metro-Goldwyn-Mayer movie studio in 1969, Kerkorian (with architect Martin Stern Jr.) opened the original MGM Grand Hotel and Casino, larger than the Empire State Building[12] and the largest hotel in the world at the time it was finished. On November 21, 1980, the original MGM Grand burned in a fire that was one of the worst disasters in Las Vegas history. The Clark County Fire Department reported 84 deaths in the fire; there were 87 deaths total, including three which occurred later as a result of injuries sustained in the fire. After only 8 months the MGM Grand reopened. Almost three months after the MGM fire, the Las Vegas Hilton caught fire, killing eight people. In 1986, Kerkorian sold the MGM Grand hotels in Las Vegas and Reno for $594 million to Bally Manufacturing. The Las Vegas property was subsequently renamed Bally’s. Spun off from Metro-Goldwyn-Mayer, MGM Resorts International owns and operates several properties, including the Bellagio, the current MGM Grand resort complex, The Mirage, the New York-New York, Circus Circus, Mandalay Bay, The Luxor, Excalibur and the newly completed CityCenter in Las Vegas. MGM sold its Treasure Island Hotel and Casino property to billionaire and former New Frontier owner Phil Ruffin for $750 million.[13]

Traductions de Las Vegas[edit] In 1962, Kerkorian bought 80 acres (32 ha) in Las Vegas, across the Las Vegas Strip from the Flamingo, for $960,000. This purchase led to the building of Caesars Palace, which rented the land from Kerkorian; the rent and eventual sale of the land to Caesars in 1968 made Kerkorian $9 million. In 1967, he bought 82 acres (33 ha) of land on Paradise Road in Las Vegas for $5 million and, with architect Martin Stern, Jr.,[11] built the International Hotel, which at the time was the largest hotel in the world; The first two performers to appear at the hotel’s enormous Showroom Internationale were Barbra Streisand and Elvis Presley. Presley brought in some 4,200 customers (and potential gamblers), every day, for 30 days straight, breaking in the process all attendance records in the county’s history. Kerkorian’s International Leisure also bought the Flamingo Hotel; eventually both hotels were sold to the Hilton Hotels Corporation and were renamed the Las Vegas Hilton and the Flamingo Hilton, respectively. After he purchased the Metro-Goldwyn-Mayer movie studio in 1969, Kerkorian (with architect Martin Stern Jr.) opened the original MGM Grand Hotel and Casino, larger than the Empire State Building[12] and the largest hotel in the world at the time it was finished. On November 21, 1980, the original MGM Grand burned in a fire that was one of the worst disasters in Las Vegas history. The Clark County Fire Department reported 84 deaths in the fire; there were 87 deaths total, including three which occurred later as a result of injuries sustained in the fire. After only 8 months the MGM Grand reopened. Almost three months after the MGM fire, the Las Vegas Hilton caught fire, killing eight people. In 1986, Kerkorian sold the MGM Grand hotels in Las Vegas and Reno for $594 million to Bally Manufacturing. The Las Vegas property was subsequently renamed Bally’s. Spun off from Metro-Goldwyn-Mayer, MGM Resorts International owns and operates several properties, including the Bellagio, the current MGM Grand resort complex, The Mirage, the New York-New York, Circus Circus, Mandalay Bay, The Luxor, Excalibur and the newly completed CityCenter in Las Vegas. MGM sold its Treasure Island Hotel and Casino property to billionaire and former New Frontier owner Phil Ruffin for $750 million.[13]

Faites glisser et déposez le fichier ou le lien ici pour traduire le document ou la page Web.

Faites glisser et déposez le lien ici pour traduire la page Web.

Le type de fichier déposé n'est pas pris en charge. Veuillez réessayer avec d'autres types de fichiers.

Le type de lien déposé n'est pas pris en charge. Veuillez réessayer avec d'autres types de liens.

Le légendaire milliardaire arméno-américain disparait à l'age de 98 ans.

Le légendaire milliardaire arméno-américain disparait à l'age de 98 ans.